Demystifying Impact Part 3: The Best IMM is Scientific and Intentional

Author: Saeyeon Kwon; Editors: Anas Attal, Isabelle Pierotti, Massiel Valladares; Managing Editor: Jaishree Singh

Distinguishing “impact investing” from “traditional investing” is detrimental in that it suggests that “finance-first” and “impact-first” are opposed and must distance themselves from each other. Ironically, new financial players are entering the market because of the unprecedented amount of capital that is flowing into impact investing, even though their objectives may not always align with those of the impact investing community.

When financial gains and unproven impact outcomes are prioritized as advertising assets rather than investment research tools to drive change, greenwashing occurs and the meaning of “impact investing” becomes hazy.

In short, intentionality is central to impact investment; it allows investors to consider what lies beyond impact investing. How can they add value to society, and what changes do they want to bring? A true impact revolution starts when we achieve measurable and attributable outcomes, capture the motivation behind chosen metrics, and avoid putting the short-term risk-return strategies and impact measurement tools ahead of innovative solutions that address social challenges directly. Therefore, impact investment should drive social innovation and not simply make investors feel good (or less guilty).

Parts 1 and 2 of our series established the growing importance of pre-investment impact measurement and optimal screening strategies for impact portfolio construction. This article will delve into the post-investment phase, introducing current frameworks like the GIIN’s IRIS+ system and B Lab’s methodologies. But first, let’s recap a few concepts.

PC: Roman Mager on Unsplash

What is Impact Measurement and Management (IMM)?

After they invest, some investors might choose to assess the social and financial outcomes of said investment. The Global Impact Investing Network (GIIN) calls impact measurement and management (IMM) one of the core characteristics of impact investing and emphasizes that transparency and accountability are key to measuring the social and environmental performance of investments.

Why is it important?

Social impact measurement is important for two reasons: Firstly, rigorous measurement enables an organization to use this information to drive value creation at the level of the investee, the investor (and their boards), and the broader market. This allows the organization to understand the outcome of its work against its social and environmental goals and to hold itself accountable to those goals. Secondly, well-designed social impact measures can attract new investors. Using data-driven evidence of financial return and social impact, IMM can facilitate deeper discussions between investors and businesses as well as align incentives among impact investing stakeholders.

As countries approach the United Nations Sustainable Development Goals (UN SDGs) 2030 targets, more capital is being driven to impact investing. As the world approaches the 2030 deadline for achieving the United Nations Sustainable Development Goals (U.N. SDGs), more private dollars are required because these goals cannot be met using public resources alone. As of Q4 2021, the global impact investing market had 1.164 trillion AUM (assets under management), and this number is only expected to increase. But more financial interest in the SDGs requires more concrete impact measures to ensure that investments genuinely contribute to societal change.

PC: Antoine Schibler on Unsplash

How does impact measurement work?

While impact investing has existed for over a decade, there is no standardized strategy for measuring impact. Instead, different institutions offer complementary methodologies that are typically broken down into three stages: measurement, evaluation, and monitoring. Of these, evaluation is the most crucial stage, since it defines the metrics investors use in the measurement stage and those that investors continue to monitor post-investment.

Measure the Result

This stage involves comparing the objectives and target indicators set in the pre-investment stage. Before any data is collected by impact investors, the Investment Impact Index suggests prioritizing what to measure and deciding the level of evidence needed to conclude one’s impact findings. As the GIIN emphasizes, investors must utilize relevant or “material” outputs, outcomes, and proxy indicators to set targets, monitor performance, and manage toward success. Ultimately, impact metrics should inform investment decisions and calculations, say related to startup valuation, deal terms, and amount invested in future fundraising rounds.

In the “measurement” stage, through data collection and indicator assessment, investors can determine whether the investment’s performance is “on track” by implementing financial data and comparing the impact target with collected impact metrics.

The European Venture Philanthropy Association provides roadmaps for venture philanthropy organizations and investors to consider three things for accurate calculation of social impact: where other programs could have contributed, for example:

A shift in government policies,

Ways in which the original situation changed on its own (e.g. “drop-off” or displacement), and 3) Other unintended consequences that might have influenced investors’ net impact (e.g. the COVID-19 pandemic forcing most workers to remain at home).

PC: Jason Goodman on Unsplash

2. Evaluate and Verify the Potential Impact

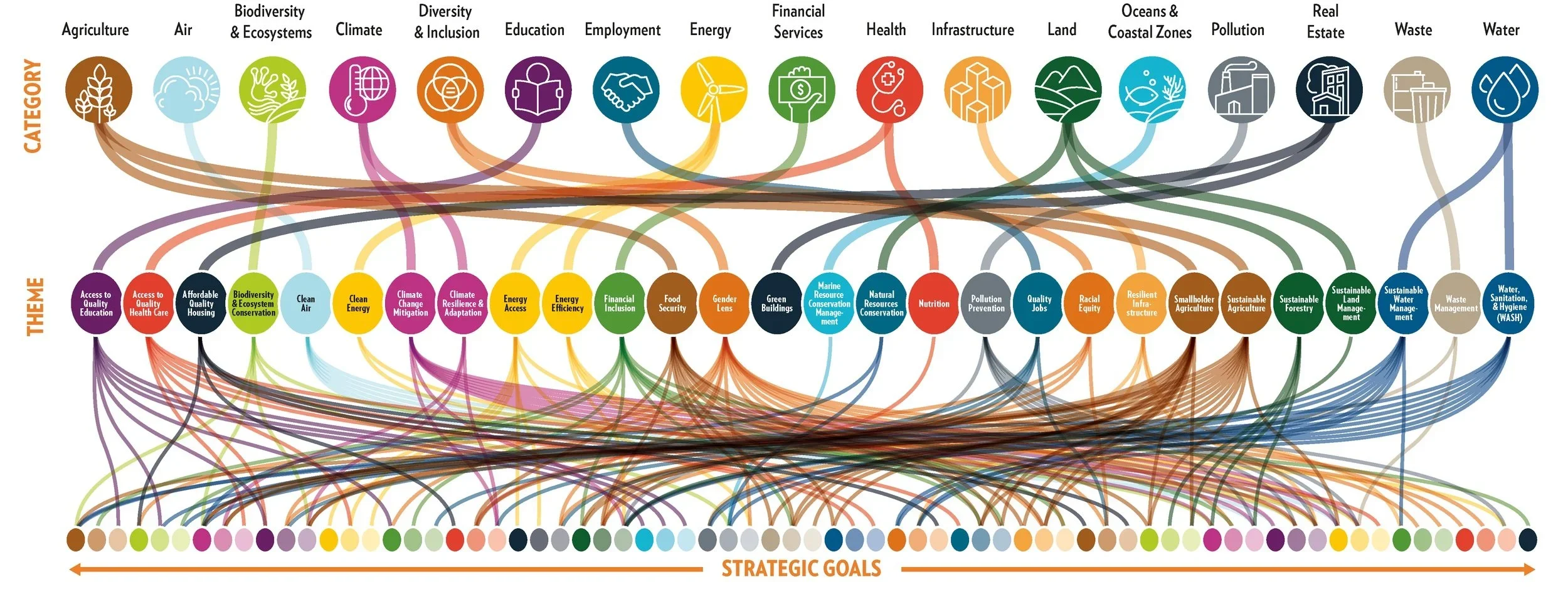

The most common impact evaluation systems are the GIIN’s IRIS+ system and B Lab’s B Impact Assessment, likely because these firms offer enormous metric libraries within relevant themes that are free and open-access (see Figure below). 2.

Of these two, the IRIS+ system is the most generally accepted impact accounting system used by leading impact investors to measure, manage, and optimize their impact. IRIS+ provides an impact metrics toolkit for 17 categories and goals, aligning with U.N. SDGs and other frameworks. Further, investors can customize the IRIS+ system to align with their own goals and map the results to IRIS+ impact metrics.

Figure: An overview of the IRIS+ system (pg. 4) and the interconnections between categories and themes possible for evaluation as of May 2021.

The B Impact Assessment is similar to the IRIS+ system but takes a more focused approach to assess the company’s practices and outputs across five categories: governance, workers, community, the environment, and customers. This framework provides industry and sector-specific questionnaires to assess the company’s contribution to the above impact areas.

Although impact evaluation methodologies allow investors to conveniently cherrypick metrics for comparing investments, investors should integrate academic and industry research in their technical diligence to verify that they are generating genuine societal impact.

For example, The European Venture Philanthropy Association recommends conducting competitive analyses between an economically similar target group in geographically and culturally distinct areas; moreover, conducting interviews with key stakeholders in a focus group can also help assess the non-financial value of an investment.

Indeed, the Operating Principle of Impact Management, a non-profit, presents a framework to help implement an impact management system throughout the entire investment life cycle, integrates such qualitative assessment into technical diligence by asking three fundamental questions: (1) What is the intended impact (2) Who experiences the intended impact? (3) How significant is the intended impact? In addition, the framework urges assessing and managing potential negative impacts of each investment from an “ESG risk” perspective so that gaps and unexpected events (e.g. climate disasters, pandemics, governance scandals) can be addressed.

3. Monitoring and Management

Analysis of an investment’s impact doesn’t end after capital is deployed but instead enters into a monitoring phase. Analogous to the evaluation stage, objectives defined and measured through indicators set in the measurement stage are used to track progress toward an investor’s impact goals. Triodos global equities, a global impact fund firm, adds “communication” as a step to their monitoring stage by reporting impact through publications and events. Such engagement with financial market participants is critical for sharing knowledge and contributing to sustainability and impact initiatives.

PC: Jason Goodman on Unsplash

Closing Thoughts

At 17AM, we set goals based on theories of change. We create our own sets of impact metrics and apply these metrics throughout the investment process to produce positive results. Having recognized the value of the SDGs to financial markets, we assess the social impact of our clients’ investments and businesses using our proprietary SDG scorecard. Our evidence-based IMM, design thinking methodology, and proactive selection of diverse clients have led 17AM to build a track record and positive reputation in Philadelphia, Pittsburgh, Boston, and Los Angeles. Through our research, partnerships, and consulting, 17AM is adding value to domestic and international communities.

In Part 4 of “Demystifying Impact,” we'll discuss the main issues within current IMM methodologies in light of the expanding investor demand for data-driven outcomes and attribution.